36 companies will be delisted by the Securities Supervision Commission

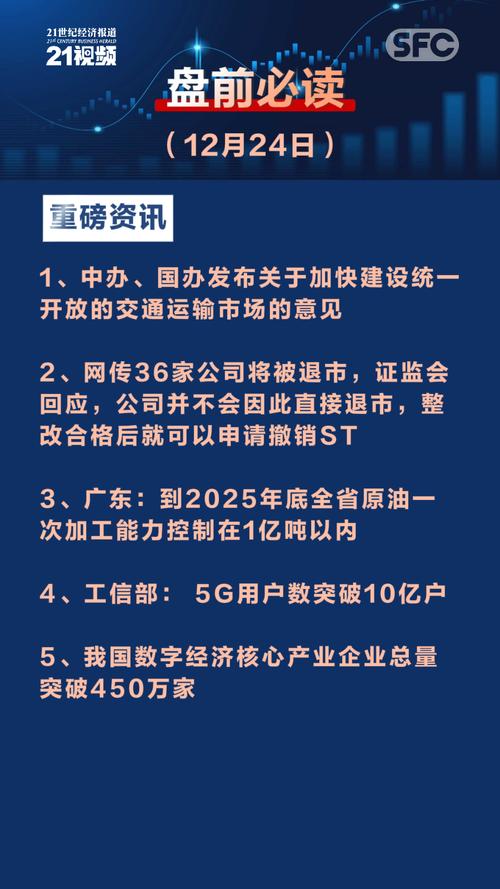

The recent news that the China Securities Supervision Commission is preparing proceedings to force 36 companies to delist has attracted widespread attention and many have expressed concern. However, the Securities Supervision Commission has not given a clear response to the veracity of the news.

First, we need to understand what a delisting is. A delisting is when a company disappears from the stock market after being disqualified from trading because it does not meet the listing requirements or because of poor business conditions. This usually occurs when the company's financial situation is in trouble, or the company cannot continue to fulfill contracts, pay debts, etc.

As for why 36 companies were forced to delist, it may be because these companies have had some problems in the past few years, such as financial fraud, illegal operations, etc., which caused their stock prices to fall and affected investor confidence. In this case, if these companies cannot recover their stock prices by improving their own situation, they may be disqualified from trading by the stock exchange and forced to withdraw from the stock market.

However, it should be pointed out that forced delisting is not a good thing. On the one hand, it may expose some investors to huge losses; on the other hand, forced delisting also poses risks to those investors who originally wanted to invest in these companies. Therefore, we need more information and data to make a decision before considering whether to support forced delisting.

In general, although it is not clear whether 36 companies were forced to delist, we can be sure that any kind of regulatory measures should be to protect the interests of investors as the core. Only in this way can the healthy and stable development of the market be truly realized.